A New Year: A New Financial Journey

CFEE12.13.23

2024 is right around the corner!

As we plan for the new year, let’s look at some financial SMART goals we can customize to stay ahead of inflation and have a stress-free 2024.

Each new year, we look for the opportunity to start fresh, often leading to the creation of the ever-popular “New Year’s resolutions.” For many of us, these resolutions don’t turn out as fruitful as we intended; gym memberships go to waste, and our plans to start eating better fizzle out after the first few weeks. This lack of follow-through often results from setting the wrong type of goal.

You’re dreaming of something better but not giving yourself the necessary pathway to get to the other side.

SMART goals are a crucial framework that makes achieving your goals as easy as possible by ensuring you thoroughly understand the objective and the path you’ll take to get there. Yes, things like going to the gym and eating better are wise or even reasonable goals, but to be a SMART goal, something must be:

S – Specific

M – Measurable

A – Action-Oriented

R – Realistic

T – Time-bound

What does this mean for a goal?

To be Specific, you want to be clear with what you’re trying to achieve. What are you doing? Why is it a goal for you? Is there a crucial benchmark for your goal? Is there anything that your goal does NOT cover?

A Measurable goal is something you can track throughout to determine your progress. Will you use a fitness tracker? An app? Visits to the gym?

Action Oriented is essential to ensure that YOU are responsible for accomplishing your goal. What do you need to do to make progress with your goal? What are the steps you need to take? Is there anything you need access to, like a gym membership or special equipment? Achieving your goals should always rely on personal actions; a goal you’re not responsible for is a wish.

Realistic goals will push you to grow and improve while setting you up for success. A goal that is too difficult or relies on too many external factors may be challenging to achieve, while a goal that is too easy doesn’t help you become a better version of yourself.

Time-bound means your goal has a clearly defined endpoint, preventing you from constantly pushing it off for another time. An ideal timeline is short enough to keep you motivated but long enough to give you the time to succeed. Consider breaking larger goals into smaller SMART sections, allowing you to celebrate your progress as you work toward the ultimate goal.

Now that you know what SMART goals are, let’s look at some examples of financial SMART goals that can help you start the New Year on a path toward improved financial capability.

Start Saving:

Savings are an essential part of managing your finances. With personal savings, you can remove some of the stress of daily expenses and eventually start to work toward preparing for the future. Personal savings can open the door to new opportunities, whether buying a car or a house, starting a family, going on vacation, or planning for retirement.

SMART “start saving” example:

S – Setting aside $250 from my first pay each month into a high-interest savings account.

M – I will track my progress by monitoring the growth within my savings account.

A – My action will be to set up automatic withdrawals through my bank, so I don’t have to worry about remembering to make the transfer.

R – Based on my current spending, this is a realistic amount to set aside and will leave me with approx. $3,000 in savings by the end of the year (depending on my pay schedule).

T – I have created a timeline for this goal by defining it as the first pay each month.

Improve my credit score:

A credit score in Canada ranges from 300-900, with a higher score representing a lower risk for lenders like banks, credit unions, and finance companies. Your credit score can be used to approve or deny personal or business loans, mortgages, car loans and leases, rental applications, credit card applications, phone plans, and much more. Establishing a strong credit score takes time and consistency, but it’s NEVER too late to start!

SMART “improve my credit score” example:

S – Pay my credit card weekly to keep my utilization low.

M – I will track my progress through my credit card app and purchase receipts.

A – I will keep my credit card receipts weekly and pay off all purchases on Sunday.

R – I will need to monitor my spending to ensure I don’t exceed my monthly budget, but I am confident the weekly check-ins will allow me to stay on track.

T – I have established a timeline of paying for purchases each Sunday.

Monitor my credit report for inaccurate information:

Your credit report is a summary of your credit history. It contains a record of borrowing, payments, debts, public records, and some bills. The two major credit bureaus in Canada, Equifax and Transunion, compile your credit report. It’s important to review your credit report to ensure that all the information included is accurate and nothing is missing. You can request a free credit report each year from Equifax and Transunion.

SMART “monitor my credit report for inaccurate information” example:

S – Request a free credit report from Equifax and Transunion on my birthday each year.

M – I will track my progress by keeping the credit reports in a folder with the date listed.

A – I will add a reminder to my personal calendar to remind me to request the report each year.

R – One free request per year is a realistic expectation.

T – It will be easier to remember by aligning the request with my birthday.

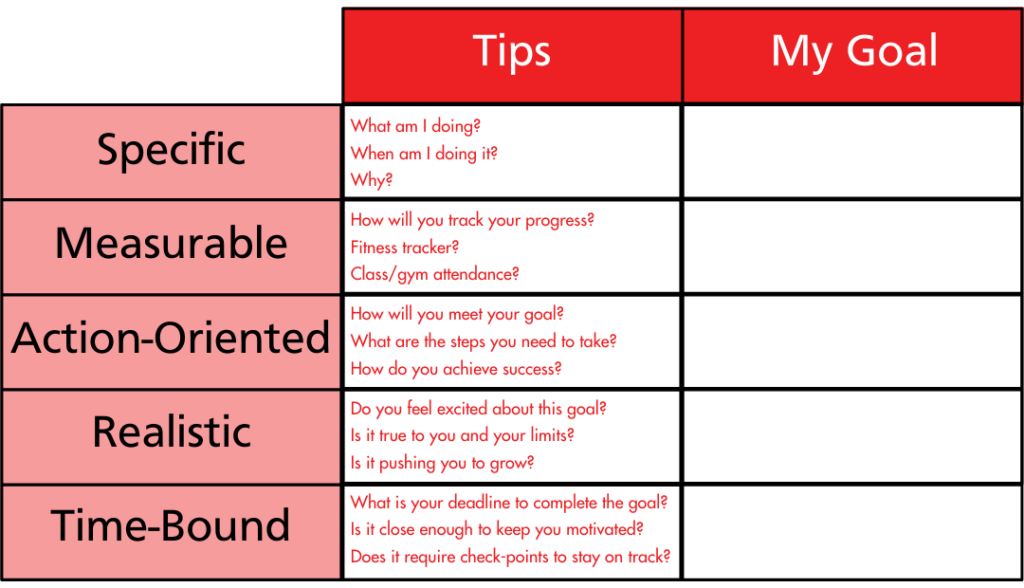

Below is a SMART goal template to help you develop your own SMART goals.