Four Pillars of Capability

CFEE01.29.24

How CFEE Supports Canadians

Spending, saving, anticipating inflation, finding and applying for a job, turning a job into a career, planning for retirement, taking risks, and making changes; the ocean of life is as demanding as it is diverse. Trying to overcome a single obstacle without considering the impact on current and future waves can be futile. Growth and accomplishment are achieved through broadening our horizons and embracing what we find. This is also true for the world of money, where we navigate personal needs, wants, and obligations through an ocean of external pressures, rising prices, and global and national trends.

At the Canadian Foundation for Economic Education, we are dedicated to helping Canadians navigate this ocean with our Four Pillars of Capability. Capability goes beyond literacy to create real, lasting change. While literacy represents information, capability represents the actions and understanding Canadians need to navigate their ocean.

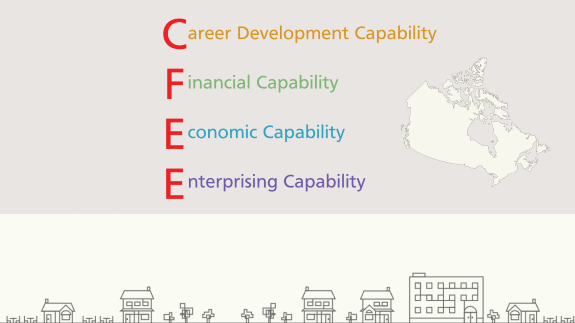

Each of our Four Pillars of Capability aligns with one of the letters in our name “CFEE”:

- Career Development Capability

- Financial Capability

- Economic Capability

- Enterprising Capability

Finding and securing employment is the first crucial step into the world of money. Your income will serve as a benchmark for your spending, borrowing, and saving capacity. CFEE helps Canadians of all ages with career development through the real-world applications and examples embedded within our programs. We can’t think about saving without considering where the money came from. An effective budget will represent all our different income sources and their variability. Even a conversation about taxes requires an understanding of income types and amounts.

Youth programs like FinLit 101 discuss tips and tricks for building an effective resume, and modules five and six of the highly successful Money and Youth: A Guide to Financial Literacy are dedicated to sources of income and career/education planning, respectively. Our extensive financial education resource for seniors, Money and You: Seniors Edition (MYSE), discusses the final stages of the career journey – retirement. The “Work and Study in Canada” video on the Managing Your Money in Canada (MYMIC) website covers some of the requirements and processes that newcomers to Canada must navigate when securing a job.

Financial capability encompasses many of the typical expectations Canadians have for the world of money. Budgeting, saving, spending, and planning for the future; financial capability represents our ability to use our income. With a thorough understanding of the reasons behind our financial decisions, making the best choice for our future will become increasingly more straightforward, especially when we struggle against new waves in the ocean of life. At CFEE, we are committed to helping future generations face the world of money with confidence and competence.

Money and Youth spends considerable time discussing financial capability through goal setting, decision making, money basics, financial control, spending, and borrowing. Modules like “Decisions to Make and Who Can Help,” “Budgeting and Maintaining Financial Control,” “Borrowing Money in Senior Years,” and “An Introduction to Retirement Income Planning” from Money and You: Seniors Edition (MYSE) show the importance of financial capability throughout our lifetime.

Unfortunately, financial and life planning decisions cannot be made in a vacuum. Inflation will have an impact on the effectiveness of our savings strategy. Interest and investments can make large and long-term goals more achievable. Trends in the housing and rental markets can impact what we can afford or the price we can expect if we are selling. Even how much it will cost to put food on the table can and will change over time. Anticipating these economic trends can be difficult, but thankfully, anyone can learn to recognize their significance and adapt their financial habits accordingly.

The FinLit 101 module “Putting Your Money to Work – Saving and Investing Money” introduces these economic ideas and how young people can prepare and adapt. Similarly, the module “Protecting Assets – and Planning for Financial Independence” of Money and Youth examines ways to protect and maintain your assets and savings from external influences. The MYMIC video “Intro and Financial System” considers the Bank of Canada’s role in managing inflation and changing interest rates.

Enterprising people are agents of change. They are opportunity seekers. They generate new ideas and help to mobilize resources to achieve change and improvement. Some become entrepreneurs and create new ventures to address needs, wants, and problems with new products and services. However, enterprising skills, behaviours, and capabilities are adaptable. Many will benefit from an enterprising person’s courage and critical thinking by starting a business, working as an employee, leading a not-for-profit social service agency, running a household, or running a school.

Enterprising skills and the confidence to use them are integrated into many CFEE programs. “Getting Money: Self Employment – Are You an Entrepreneur?” from FinLit 101 covers the traits and skills of entrepreneurs and the numerous ways they contribute to the job market and economy. Money and Youth’s “Are You an Entrepreneur?” goes into the role an entrepreneurial person can play within a larger organization and how to determine if it is the correct type of career path for you.

What do you think of our Four Pillars of Capability? Let us know! Follow the Canadian Foundation for Economic Education on Facebook, LinkedIn, and Instagram to share your thoughts on our four pillars and stay up-to-date on programs, resources, and events.